Implementation first

When you are in a crisis – the actions you take straight away using whatever tools you have to hand are far more impactful that anything you do in the future.

Applying that to tackling dangerous climate change, anything we do now has many times greater impact than anything we do in 10 years’ time. So, if your aim is to invest to help minimise dangerous climate change, it makes sense to prioritise investment in rapid implementation, such as funding installation of solar on rooftops.

But that’s not how many in the “impact investment” community seem to go about it.

Put the fire out with the equipment we already have

Imagine if the world was a house, and that house kept catching fire. Already invented was perfectly good fire equipment to put out the fire and minimise the risk of future fires, we just didn’t have enough of it. But we did have plenty of money to produce and distribute more of that equipment.

Would you:-

- (A) Use the money available to produce and deploy existing versions of equipment to quickly put out the fire and stop further fires; or

- (B) Allow the fire to rage, destroying more and more of our home/world and the life in it whilst funding the development of new types of equipment which will hopefully make fire extinguishing and fire prevention more efficient at some point in the future – but equally but might not work at all or might only work once most of the world and its inhabitants are in cinders?

I imagine (or hope) that you are going for Option A here.

Now of course, the best case scenario is that you spend the money available on both. Once you have put as much money as necessary into rapidly producing and deploying existing versions of equipment to quickly put out the fire, and stop further fires, you then put funds left over into developing better and more efficient equipment for the future.

But that isn’t how most money supposedly invested for climate impact currently seems to be spent.

Right now we have all the equipment and ideas that we need to rapidly reduce the output of greenhouse gases into our atmosphere and to speed up their store and capture by our natural world. But most of the money that is going into so-called impact investment is still going into innovating and developing solutions that may or may not work in the, sometimes quite distant, future – instead of into deploying the solutions we already have.

The reason for that is that most impact investing is more about hoping to make big bucks than big impact. Plus, many of those offering so called “impact investments”, are not willing to contemplate solutions that involve taking a pause and consuming a bit less now so that all life on Earth has a chance of a safer future.

Getting on with it

Right now, it feels like in money terms impact investment is say 95% innovation and at most 5% implementation. That’s because big money chases more big money. For big money, financial return will always come 1st, 2nd ….. 5th ….. 10th – with impact way at the back.

So whether you have a few hundred pounds to invest, or you are a wealthy person looking to achieve some good with your wealth you have a chance to redress the balance and focus on supporting those getting on with achieving change now.

Impact, financial return, risk, timescale

There are lots of issues to consider around investments that I can’t cover here, and which are better covered by those with far more expertise than me, such as

FSCS – Financial Services Compensation Scheme

Here I just share some thoughts and suggestions based on my very steep learning curve going from basically having no investments (apart from in the company I helped found and my house) to having a diverse spread of investments focused on protecting and restoring safe living conditions on Earth.

The types of investment for impact which are appropriate for you will depend on:-

- How much money you are able to invest

- For how long you can/want to tie up your money

- How important it is for you to receive a financial return

- Can you afford to lose the money you invest

- How much time and effort you want to put in.

Below are some of the types of investments for impact I have made and my view (as an amateur not a financial professional) on how they rate for each of the above factors.

Philanthropic loans

These are loans made to a charity or not for profit organisation to help them get started on a project which will provide funds to then pay back your loan.

Along with a small group of other Nature Funders, I have provided loans to Wildlife Trusts and other charities and community groups to help them buy land to restore to nature and people.

You can find out more about this at Funding nature.

Led by Tim Stumpff, and along with another small group of Community Energy Accelerators, we provide bridging loans to community energy companies so that they can start installing community energy projects quicker and then pay us back from the proceeds of community share offers.

You can find out more about this at Community energy.

I see this form of investing for impact as:-

- Impact – high

- Financial return – none or low/moderate

- Risk – low in the long term provided that you are lending for the purchase of land or where there is a very clear and identified route to repayment.

- Timescale – varies depending on the project. Those I have been involved in have ranged from 6 months to 5 years

- Amounts – the amount really depends on the project being supported. Loans I’ve been involved in range from about £50,000 up to several million pounds.

- Hassle/admin – moderate

Community energy

This is investment in community energy companies – who install renewable energy and energy efficiency measures at a local level.

You can find out more about these at Community energy.

I see this form of investing for impact as:-

- Impact – high

- Financial return – moderate. Generally a bit better than savings account interest.

- Risk – pretty low in the long term.

- Timescale – generally quite long term although options to remove your money early – check detail for each community energy share offer.

- Amounts – minimum investment is often between £100 and £250.

- Hassle/admin – low

Crowdfunding

This offers a way to invest relatively small amounts to support a new business or project via an online platform.

Investments are generally in:-

- Shares – also known as equity – where you own a small part of a company as a shareholder. You hope that at some point the company will become profitable and either pay dividends to shareholders or be sold, in which case your shares will hopefully be bought for more than you paid for them. The risk is that the company never becomes profitable and you don’t get your investment back; or

- Bonds – a loan to a company or organisation – usually with a fixed term and interest rate. Here you generally know how much of a financial return you will receive and when you will be repaid, but there is still a risk that the company/organisation goes bust and your investment isn’t returned.

Crowdfunding is high risk – see What is crowdfunding? | FSCS

Some crowdfunding platforms simply offer opportunities to invest in companies and leave it to you to do your own assessment of the company (called due diligence).

The following organizations carry out at least some due diligence before offering an investment for impact opportunity on their platform.

I see this form of investing for impact as:-

- Impact – potentially high depending on the project/company

- Financial return – if a bond then often moderate. If shares/equity then high risk that none but possible for anything from low, to moderate to high.

- Risk – if equity then high. If bonds can be low to moderate.

- Timescale – if equity then long term. If bonds medium to long term.

- Amounts – minimum investment for Triodos as at May 2024 is £50.

- Hassle/admin – moderate

Angel investing

This is where you invest directly in a company, often a fairly newly set up company.

Investment is generally in:-

- Shares/equity; or

- A loan with an option to convert into shares – generally through a convertible loan note.

Sometimes the price of the shares are not yet set – but instead are offered at a discount to a future round price with a minimum and maximum amount under an Advance Subscription Agreement.

If you are already thinking that this all sounds a bit complicated then you are right. Before getting involved in this type of investment you generally need a fair bit of confidence. That being said – this type of investment is often provided by friends and family of the founders of the business or by potential customers or users.

This type of investing can also create a fair amount of admin – its not for someone who wants to keep things very simple.

When you invest in shares (equity) you own a small part of a company as a shareholder. You hope that at some point the company will become profitable and either pay dividends to shareholders or be sold, in which case you hope that your shares will be bought for more than you paid for them. The risk is that the company never becomes profitable and you don’t get your investment back. If your primary focus is on impact you may be willing to accept that – after all, if you donate money to a charity for a project you definitely will not get your money back. Here at least there is a chance.

There is a big emphasis in this sphere of focusing on companies growing fast and then being sold (called an exit). Many investors aren’t interested in having their money tied up long term and receiving a dividend. They aim to invest in a few companies which sell for many times the amount which they invested – delivering a return which compensates for the many failures they inevitably invest in.

The failure rate for new companies is very high. You should not get involved in this type of investing unless you understand and accept that there is a high chance that you will not get your money back.

That being said, investing in companies that are delivering solutions to identified environmental problems is a key part of my strategy. I am not looking for a quick exit – indeed I would love to see the founders I invest in able to continue guiding their companies for as long as possible, whilst getting a suitable financial return to compensate for the incredible effort and sleepless nights expended by most founders.

There is a gradually developing movement of a different way of doing business and investing as illustrated by companies like Library of Things – who are open about not offering a massive financial return for investors – but instead focusing on sensible steady growth and high impact. You can read about their stewardship business model here.

If you are interested in giving angel investing a go, a sensible starting point is as part of a syndicate. I initially invested through Green Angel Ventures which was a good way to learn about the different ways investments are structured and the issues to look out for in assessing an investment opportunity (due diligence).

I now invest directly and below I share a few of the companies I have invested in and why I think that they form a key part of the investing for impact jigsaw puzzle – each tackling the environmental impacts of a different aspect of modern life and making sustainable living possible.

I see this form of investing for impact as:-

- Impact – potentially high but very much depends on company

- Financial return – high risk that none but possible for anything from low, to moderate to high.

- Risk – very high.

- Timescale – potentially very long term.

- Amounts – will depend on the company. As a rough guide – some companies may set minimum at £5,000 – others at £100,000 and above.

- Hassle/admin – high

Being willing to invest for progress and being willing to risk zero financial return

If you have enough money to be considering making major donations to charity or setting up a charitable trust, you could also consider investing in companies who are at an early stage in tackling complex problems like single use waste, accepting that there is a high risk that the companies will not succeed financially but in the hope that they help move us closer to solutions.

Reducing waste

I have taken this approach to tackling single use waste and reducing consumption of new. Whilst some impact investors are fixated on carbon reduction – to protect safe living conditions on Earth we need to reduce most forms of human consumption – and move towards a higher welfare, healthier, higher space for nature – lower consumption of new materials way of living.

When I first sold my stake in Osprey Europe I set aside part of the proceeds to donate to charity and my initial donations were focused on tackling plastic pollution. This was an issue that had always concerned me and I had always tried to minimise waste myself. I was buying dried goods in bulk to reduce grocery packaging waste before refill was a concept much talked about, I used a Mooncup to avoid single use period waste and reusable nappies for both of my sons.

Around this time Blue Planet aired and bought a heightened awareness of plastic pollution – in particular its devastating impact on marine life. But whilst people became more aware of the issues, and there was a demand for change – people often found that in practice it was difficult to opt for the less plastic option.

At this time I donated to support a number of charity campaigns including:-

- Greenpeace Supermarket plastic packaging league table

- Friends of the Earth Phase-out of Plastic Pollution Bill and takeaway plastic campaign

- City to Sea – campaigns on Plastic free travel – focusing on issues like replacing hotel mini toiletries with refill dispensers and supporting their Refill campaign – encouraging people to carry a refillable water bottle and highlighting where people could get them refilled when out and about

- EOCA – European Outdoor Conservation Association’s Plastic free trade shows pledge

Some great progress was made – in particular with encouraging several large hotel chains to scrap mini toiletries – but ultimately it was still difficult for people to shop plastic free. Plus Covid bought with it a vast array of new single use mostly plastic waste, in the form of PPE, coffee chains refusing to refill reusable coffee cups, and many hospitality providers jumping on the opportunity to replace paying staff to wash up with throw away plastic cups etc.

It was at this time that I was starting out with my first angel investments. I took the view that instead of donating more money to charities to campaign, awareness raise and lobby – I could have more impact in investing in companies who were just getting on with it – and attempting the difficult task of providing a reuse solution in a world where we effectively subsidise single use by not charging the companies that churn it out with the cost of dealing with its huge environmental damage.

I made some wrong turns – and invested in companies which ultimately didn’t make it, including:-

- Ecoeats – attempting to supply take away food in reusables.

- Draught Drop – craft beer supplied in refilled bottles

- Circla – toiletries in refilled containers.

These companies didn’t survive for a variety of reasons. But despite that they did play an important role in moving forward acceptance of the need to replace single use with reuse and refill. So ultimately these investments provided equally good impact value for money as equivalent charity donations towards tackling single use waste.

They were also an important part of my learning process.

Reuse and refill

Whilst the companies above didn’t make it – as at May 2024 the following companies are going strong and providing the services and solutions we need to move from our current extract and throw economy to a genuinely circular economy where we treat the Earth’s precious resources with respect and aim to use them to their full capacity and to waste as little as possible.

Dizzie provide a comprehensive reuse and refill service for groceries. They have invested heavily in researching and designing effective and efficient systems which enable food to be supplied in reusable, washable and refillable containers – which can then be recycled back into reusable containers at end of life.

This isn’t as easy as it sounds and many factors had to be developed, tried and tested – from:-

- the right shape containers for filling, washing, stacking, labelling

- the right labels for ease of removal and application

- the most efficient washing and drying process

- reverse logistics – workable solutions for getting used containers back from customers and to the wash facility.

When I first invested in Dizzie they were called The Good Club and were an online grocery focused on supplying organic and sustainable produce at affordable prices. They were considering exploring reusable containers but when Covid hit initially decided to focus on expanding customer base and so planned to delay this development. In my view it was reuse and refilled that could make the company impactful and so I invested an additional sum to cover initial work on their reuse/refilled solution and from there the company’s focus has pivoted to reuse/refilled. This is my largest single investment and one that has already delivered enormous impact.

Dizzie’s founder Ben Patten brings incredible focus, knowledge and commitment to the company.

Dizzie have chosen a hard nut to crack but luckily between them the Dizzie team are making fantastic progress. If interested in finding out more you can contact hello@getdizzie.com.

Again are another company providing the supply chain infrastructure to allow brands to reuse the same packaging again and again. Again have focused on developing a clean cell washing facility and are working with a number of brewery chains.

For more information contact partnerships@letsuseagain.com.

Revolution-ZERO are tackling the massive supply, pollution and emission issues with single-use medical textiles including PPE, surgeons’ gowns and operating theatre drapes.

To do this they are designing and manufacturing high performance reusable alternatives supplying the NHS, private health providers, dentists, vets and more – aiming to replace an Everest size mountain of plastic single use waste.

After use they reprocess the products in high tech, low energy state of the art facilities designed to minimise environmental impact of laundry and sterilisation systems.

The entire system is supported by a digital platform that allows improved efficiency, compliance with healthcare regulations, tracking of the products and reporting on the environmental impact of the system – in real time.

Anyone that has been in a hospital recently will understand the mind boggling quantities of waste being generated. Founder Tom Dawson is a medic and has so much energy it leaves you breathless. He has bought together an incredibly impressive team with extensive experience and contacts in health care and sustainability.

Tom Dawson, founder “We are incredibly thankful of the support provided by Julia. To be part of her team that are bound together through investment and a common vision to save and restore our precious world is great. Julia’s investments and other support has provided us with a strong foundation to now deliver at scale and make the impact that is critically needed both in the UK and across the globe.”

If interested in finding out more you can contact investment@revolution-zero.com.

Up to 2 billion period products are flushed down the toilet in the UK each year, blocking our sewers and creating overflow that escapes into our rivers and seas. Pollution from single use period products is vast and you can find out more stats at City to Sea’s Plastic Free Periods webpages.

As soon as I became aware of the Mooncup menstrual cup I switched from single use period products.

When I first came across period pants I was delighted. I know you may find it a bit odd – but it got me really excited. For years I had tried to encourage young friends and family members to switch to the Mooncup. Whilst many did and loved it, for others they just weren’t comfortable with a product which you insert, particularly those just starting out on their periods.

Period pants and menstrual cups together offer the potential to banish single use period products to the past, like Kodak film – something weird that your gran used to use.

So I looked around for a company producing good quality period pants, roping in my son’s girlfriend to try out a range of brands. I then came across &Sisters and could immediately see the quality of their products. Poor quality period products are just another form of waste.

After chatting to the founder Lucy Lettice and her husband and CEO Charlie Cohen I invested in the company.

A few years later and I was over the moon (sorry) to hear that &Sisters had bought Mooncup – bringing together 2 titans in battle to make single use period products extinct – a fitting end to a product that had blighted the lives of so many marine animals.

An added bonus of reusable period products is that they can also help tackle period poverty. They may be a bit more expensive to buy in the first – but once bought an annoying monthly expense is gone for ever.

Charlie Cohen has a background in chemistry and is a total geek when it comes to absorbent fabrics, but with a sharp business brain to go with it.

The company isn’t currently raising funds but if interested in stocking its products contact trade@andsisters.com.

If you would like to offer Mooncup/ &Sisters products to your employees as part of your wellbeing, sustainability, environmental policies get in touch at

Period Care for Business | &SISTERS by Mooncup® (andsisters.com)

Lucy Lettice, founder “Solving the climate crisis is about prioritising solutions that are ready to be deployed on a large scale. We need investors who are dedicated to supporting the implementation and widespread adoption of these solutions. The scale of the problem we are addressing is immense: in the UK alone, 4.3 billion menstrual products are used annually, leading to 1.5-2 billion items being flushed down toilets each year. These products, which do not biodegrade, contribute significantly to non-biodegradable waste, making up 30% of landfill content. We need investors who share this vision and ethos and are ready to consider impact within their return models, without this, the climate crisis presents an insurmountable challenge.”

Lucy Lettice, founder “Solving the climate crisis is about prioritising solutions that are ready to be deployed on a large scale. We need investors who are dedicated to supporting the implementation and widespread adoption of these solutions. The scale of the problem we are addressing is immense: in the UK alone, 4.3 billion menstrual products are used annually, leading to 1.5-2 billion items being flushed down toilets each year. These products, which do not biodegrade, contribute significantly to non-biodegradable waste, making up 30% of landfill content. We need investors who share this vision and ethos and are ready to consider impact within their return models, without this, the climate crisis presents an insurmountable challenge.”

Charlie Cohen, CEO “Addressing challenging areas with a profound impact on the natural world demands investors who are deeply engaged with the business, the problem at hand, and the ultimate goal. It’s crucial to have supporters who prioritise the impact of our work over mere financial returns. We believe that transforming the menstrual product industry from one dominated by conventional disposable items, which generate 200,000 tonnes of waste annually in the UK alone, into a more sustainable model requires this level of commitment and vision.”

Reducing consumption of new

Simply moving all energy production to renewables is not enough.

If we want to protect and restore safe living conditions we have to massively reduce consumption of new goods.

This isn’t just about reducing extraction of new materials. It’s also about the vast waste created by discarded goods plus the huge energy consumption, pollution and disruption to marine life caused by shipping new goods round the world. Shopping till we drop by humans is literally stressing out whales and other marine life, it is making it difficult for marine life to communicate and so mate and so its disrupting the lives and family life of marine animals. All so we can keep on buying not just tat, but equally luxury goods and all those other things that we think we need, but in many cases we really just want.

This is why I have always been a big fan of buying second hand – and best of all buying from charity shops which is a triple win:-

- Reducing purchases of new

- Saving items from landfill

- Your money funds great causes instead of corporate profits (and, in the case of Amazon, Jeff’s space hobby).

No matter whether it’s made from plastic or it’s the cheapest fast fashion – in sustainability terms purchasing something from a charity shop does not encourage more production and so is more sustainable than buying even the most sustainably produced, Fair Trade certified, made from organic cotton whatever.

When my kids were growing up our house was full of plastic toys and kids’ books bought from charity shops. There was nothing that pained me more than the boys being given new toys, that they didn’t even want past the momentary kick of opening them, which inevitably came in an excess of packaging to make whatever it was look like a bigger and more impressive present. In a big family the waste created by Christmas present giving could make me cry.

But whilst charity shops are great if you have the time to hunt, they are not a convenient way of finding the items you need/want and so in their current form they are unlikely to significantly reduce purchases of new. Online shopping, and in particular Jeff’s Space Hobby Funder (Amazon), have groomed people into expecting extreme convenience and so to make inroads into replacing purchases of new with second hand a more convenient customer experience is needed. Luckily there are lots of fantastic companies now offering this and I have invested I several of them including:-

The Cirkel – higher end fashion and occasion wear. Both online and you can also shop in person at an increasing number of pop-ups plus in-store outlets.

Thrift+ – clothing

Rent not buy

There are so many items that we buy and use infrequently. They just take up space around the house, or in the garage if you are lucky enough to have one.

In many instances renting would make far more sense, and provide the opportunity to use better quality items.

Library of Things do just this and more. Not only are they trail blazing the sharing economy but they are also helping to develop a better way of setting up and running a business.

Library of Things is a mission-locked and ‘steward-owned’ business. You can read about what that means here.

Reducing energy consumption

Even better than replacing energy from oil, gas and coal with renewable energy – is simply reducing energy consumption – especially whilst we increase renewable energy production.

All forms of energy production have adverse impacts on safe living conditions – just to differing degrees. Solar and wind are undoubtedly much less harmful than oil, gas and coal – but they are not without environmental costs – requiring the extraction of materials to produce the infrastructure, creating often unrecyclable waste and adversely impacting wildlife including on the sea bed and bats/birds.

None of these adverse impacts justify continuing with oil, gas and coal instead of renewables – as the adverse impacts of these energy sources are far worse. Flaring from oil rigs kills more birds than wind turbines. There is no such thing as a wind turbine spill. Plus of course oil, gas and coal fumes also make the air in our towns and cities toxic for both people and other species.

We need to transition to renewables but we shouldn’t see that as letting us off the hook for reducing our energy consumption – especially in the short term where oil, gas and coal still dominate. So a key focus for my investment is energy saving.

Some of my favourite investments are in companies providing solutions to problems I faced or had identified. Byway is definitely one of them.

When I was younger I didn’t travel all that much. Then for a long time I was head down raising kids, helping get Osprey Europe off the ground, running a small legal practice, supporting my family.

So when I started to feel a bit wealthier as Osprey Europe took off and then as I sold my stake in Osprey Europe I had a bit of a travel binge. Along with my sons, or with friends, I was able to travel to some of the places I had always dreamed of – seeing incredible wildlife in the wild in Africa, scuba diving, hiking, trekking in South America, touring Sri Lanka. With my sons I scaled Kilimanjaro and other mountains and travelled around the world to experience New Zealand and Australia.

I know exactly when my favourite moment was – it was swimming with sea lions with my sons in the Galapagos – with the young poking their whiskered faces up to our snorkelling masks and nibbling fingers.

I kidded myself that all this flying was ok – because I was now donating major sums to environmental charities, I was vegetarian, had an electric car, solar and an ASHP, I was investing in renewables. But I knew that was nonsense.

Eventually I accepted that that isn’t how it works. If we are in a climate crisis caused by oil and gas pollution we need to reduce our consumption – and doing a bit of good didn’t compensate for a big bad.

So in January 2020 after a fabulous trip to Vietnam and Cambodia I paused flying. Of course initially that was easy – with Covid and all.

But then the itchy feet started again. So I started looking around for someone who could help me arrange a trip without flying. I contacted Flight Free UK and they replied – “we can’t help – but what a great idea”. Then someone put me in touch with Byway who were just starting to raise funds after being incubated with Founders Factory.

I got on with Cat Jones, Byway’s founder straight away and I have to say that she is one of the most impressive founders I have come across. She makes you feel lucky to be allowed to invest in her company! I really love her confidence which is well justified as she is very strategic in her planning.

A few years later and I’m not just an investor in Byway but a frequent customer – with at least 6 Byway trips in the bag – all fabulous including Sardinia, Scottish Highlands, Croatia, Greece, Zermatt for skiing and a Paris mini-break.

Byway aren’t currently raising funds but I hope you’ll have a look at the great trip selection on their website.

Cat Jones, founder “Having an investor who doesn’t just put in money – but also ideas and feedback is invaluable. Julia supports and understands our mission and not only is a top customer, but also shares detailed feedback and suggestions after each trip. Not to mention sharing her love of Byway at every opportunity. She is genuinely one of the most supportive, thoughtful, and creative investors, and we feel very lucky to have Julia on our team.”

Energy transition

As a working mum I have always loved multi-tasking and so from the beginning I was drawn to Kleandrive as it achieves so many aims in one.

Kleandrive provide modular solutions to retrofit diesel vehicles to electric. Initially they are focused on buses but their technology is just as adaptable to HGVs, tractors and even boats.

So in one investment I am investing in:-

- Transition from oil and gas

- Clean air

- Circular economy through reuse of the considerable environmental footprint of the vehicle shell and fittings – all aside from the engine – which can itself be reused for parts on those buses in the fleet not yet retrofitted to electric

- Creation of quality jobs throughout the country – including in areas where needed most. Once the retrofit solution for a particular model has been designed and developed by Kleandrive, the actual refit can take place in situ at the fleet operators sites across the country.

If interested in finding out more about the Kleandrive mission contact Joe Tighe j.tighe@kleandrive.earth.

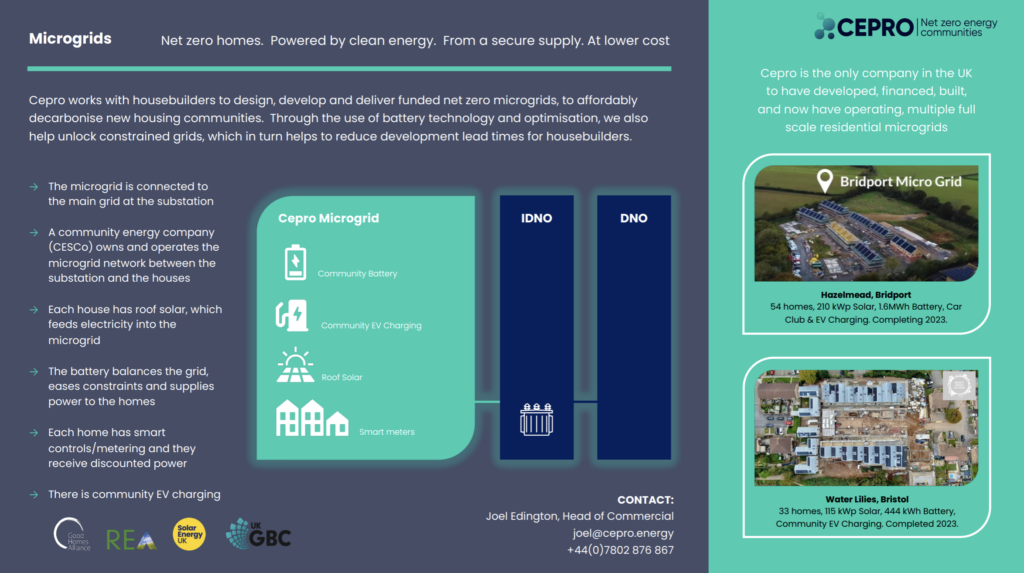

A top priority has to be transitioning our homes from oil and gas and new homes are a great starting point. Cepro are at the forefront of providing the tools that make microgrids work, not only ensuring that new housing is, as far possible, oil and gas free from the outset – but also offering grid balancing to nearby housing through night storage of electricity in batteries. This image explains what Cepro do better than I can.

An astonishing quarter of all the energy the world uses goes into making industrial heat. It’s a figure that’s hard to grasp, but when you consider the immense amount of energy required to produce the goods we use daily, from beer to pharmaceuticals, it starts to make sense.

Caldera converts renewable electricity into on-demand industrial heat, offering a clean, reliable, and affordable alternative to conventional fossil fuel boilers. Caldera heat batteries use volcanic rock and recycled aluminium, making them more sustainable and durable than traditional batteries.

To make the numbers work, the team at Caldera often recommend integrating their thermal storage system with on-site solar. For many sites that means they can provide renewable heat at a price that is competitive with gas, even in British weather.

If interested in learning more, contact invest@caldera.co.uk.